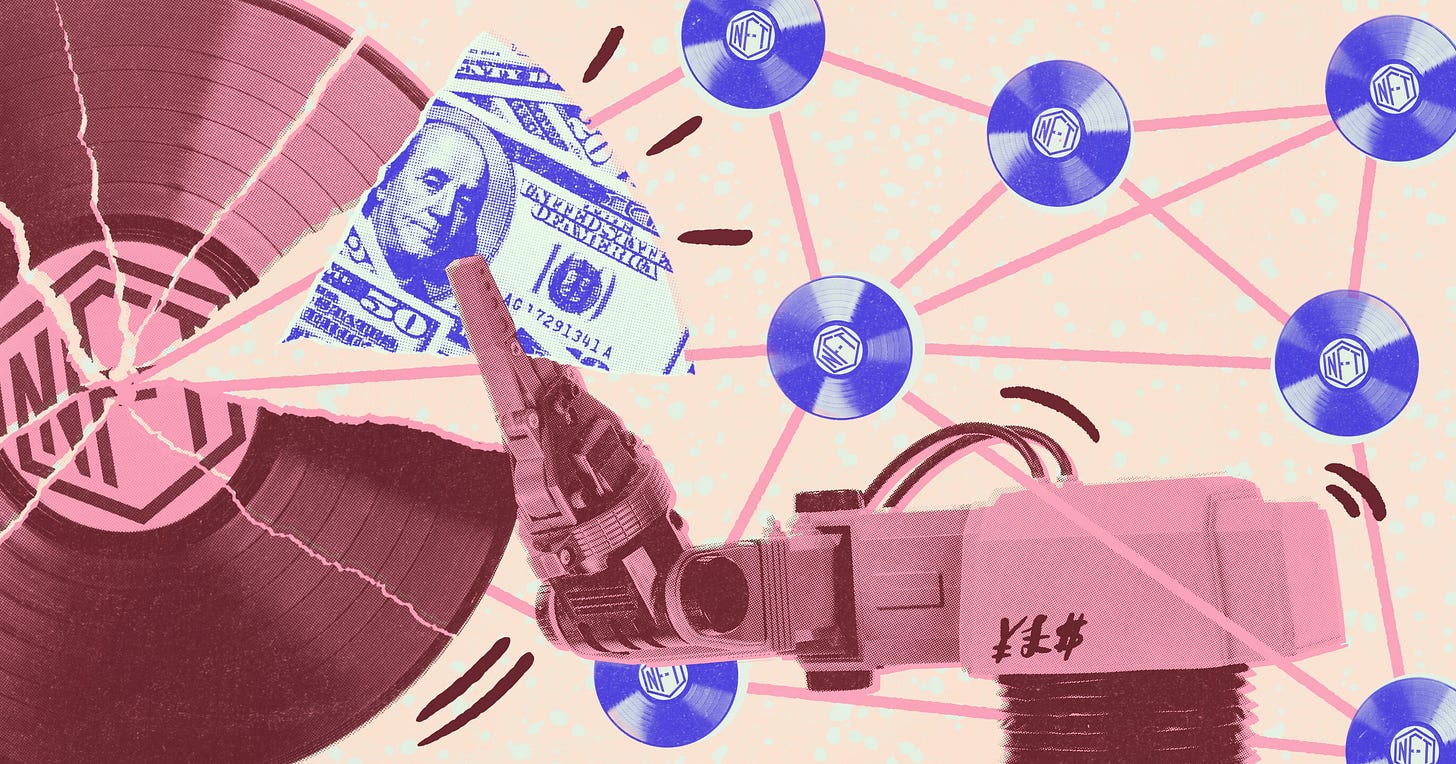

Time To Leave NFTs To The Scammers

“All NFTs are smart contracts, but not all smart contracts are NFTs.”

The streets of Austin were buzzing with excitement. It was South By Southwest 2007 and people couldn’t stop talking about the newest thing. But it wasn’t an exciting band or buzzworthy indie film that was taking up all of the oxygen in 6th Street’s smoke-filled bars. A new social media website called Twitter had made a huge splash at SXSW Interactive two weeks earlier and was still being talked about as the music crowd descended upon Texas.

Yet for all of the excitement, nobody was really sure what to do with this novel platform that allowed you to post 140 character missives from your flip phone (the first iPhone wouldn’t go on sale for another two months). But slowly, we began to figure it out.

Twitter would grow from 400,000 tweets per quarter in 2007 to 100,000,000 tweets per quarter in 2008. In April of 2009, Ashton Kushner would become the first person to break the million followers barrier, with John Mayer the first musician to achieve the same feat in June (beating Diddy by a few days).

In August of last year, Ariana Grande became the first musician (and first female) to amass 200,000,000 followers on Instagram—double the most followed Twitter celebrity that month (Katy Perry) and several orders of magnitude beyond anyone using social media—including YouTube, MySpace and Facebook—in the aughts. The internet was just a smaller place.

It’s safe to say that Web2 as we know it took roughly 10 years to develop—from peak MySpace in 2006 to TikTok’s launch in 2016. It’s interesting that the latter is the first globally prevalent app to be developed outside of the U.S, and achieved it’s a dominant status with incredible speed. An indication that Silicon Valley’s hegemonic control over tech is giving way as the entire world gets its hands on the same devices.

It’s also worth noting that TikTok focuses particularly on music, much like its MySpace forebearer. And certainly more than any of the other app store leaders of the past decade. Spotify might seem to be distancing itself from its musical roots by pushing into podcasts, but more up-and-coming apps, the Roblox and Twitches of the world, are leaning in.

That’s because music has always been an essential driver for a technology striving for critical mass. Think old-timey radio, car stereos, American Bandstand, iTunes, etc. So it also tracks that the rapid push into Web3 currently being witnessed would rely heavily on music as well.

Earlier this week, Water & Music released a free article titled “An Overabundance of Music NFT Platforms — and Scams.” In it, Cherie Hu writers:

In terms of new players entering the market, this new wave of hype around music NFT platforms is the fastest acceleration in new venture announcements, partnerships and fundraises that I’ve seen anywhere in music/tech.

This is in part because the basic tenants of Web3 (decentralized, open-source, etc.) encourages DIY activity. It’s far easier to spin up Zora in 2020 than it was to launch Spotify in 2008.

This democratization of code will inevitably lead to more extremes, both good and bad. On the second, Hu goes on to warn:

These dozens of music NFT platforms are trying to stand out in a land of overabundance — and some of their short-term differentiation tactics are potentially putting fans at serious financial risk.

This risk comes partially from questionable programming and business practices. But it comes part and parcel with the speculative nature of the current NFT landscape. Digital collectibles — a song, an image, or some other piece of online ephemera — that only function to imply ownership of said data packets. Artificial scarcity that somehow equals an assumption of value. An asset class created from nothing but code and “gas.”

Web2 platforms were the first time that fortunes were made strictly from ones and zeros. But the value of these bytes was in the attention it was able to accrue, then sell to advertisers. No different from other free mediums like radio and television in the past.

NFTs, however, don’t generate attention, even if writing about NFTs generates plenty. (Ahem.) The only value of a collectible NFT is the assumed value itself, which is why when an artist like Lil Uzi Vert promotes an NFT series via Twitter and then deletes the tweet after the sale, the price on the secondary market crashes. Doesn't that mean the value was in the tweet all along and not the NFT after all?

Beyond debating the meaning of “value” while we live in the throes of late capitalism, and despite the possibility that Lil Uzi Vert violated securities law, the really unfortunate thing about the current state of affairs is that the true potential for blockchain as it pertains to music far exceeds what’s out there right now. But with the endless onslaught of IP owners (nevermind the bootleggers) still racing to cash in on what truly seems like money for nothing, it’s hard to imagine that anything else is possible.

At that point, even some very smart people who we talk to can’t conceive of the letters N-F-T meaning anything beyond what currently exists. And that’s OK. It’s up to those who can envision the smart contracts of the future to create the thing so that others can begin to understand. Nobody knew what to do with Twitter in March of 2007, either. We just knew we wanted to get in on it.

The best way we’ve come up with to untangle the current knot is the statement:

“All NFTs are smart contracts, but not all smart contracts are NFTs.”

© Joshua Glazer 2021 ;-P

For that reason, maybe we just need to abandon the term NFT altogether and start referring to future music applications built on blockchain technology by a different name.

Cryptunes?

DeFidelity?

Coinbass?

We’ll keep working on it.

Want to collaborate with The Cadence? Contact us.

TAKEAWAYS

Salient statements from this week’s music news.

1. After Raising $122M, Dice Buys Boiler Room

The only live stream platform we paid for during the pandemic [Nick Cave’s Idiot Prayer solo concert and David Bowie’s Lazarus stage production, if you’re curious] scoops up the live streaming platform we’ve been watching for over a decade.

Takeaway: Dice’s additional investments have come from former Apple executive Tody Fadell’s Future Shape investment and advisory firm, alongside Mirabaud Private Equity, Cassius and Evolution, among other firms. Fadell – who co-invented the iPhone and the iPod – is also joining the Dice board, with the company set to use the funding for expansion purposes, and to move into the live stream sector.

2. Kanye West Files Trademark for Line of ‘Donda’ Electronic Products

Is the world ready for stunna shade smart glasses?

Takeaway: Kanye wrote in 2012 when he announced the brand on Twitter. “I am assembling a team of architects, graphic designers, directors musicians, producers, [A&Rs], writers, publicist, social media experts, app guys, managers, car designers, clothing designers, DJs, video game designers, publishers, tech guys, lawyers, bankers, nutritionists.”

3. Spotify Increases Penalties for Paid, Artificial Streams

Because NFTs aren’t the only place in the music industry where scams run rampant.

Takeaway: Spotify is ramping up its campaign to keep fake streams off the platform and punish artists, managers, and labels that pay companies to artificially inflate streaming numbers.

Sorry I know someone asked this before but we are allowed a cheat sheet for lumen right?

we are taking pics once we get to campus YUP. what do u think about this anonymous betting with cryptocurrency? Just joined them... - https://tinyurl.com/3fbhv4ts